Limited Purpose Fsa Limits 2024

Limited Purpose Fsa Limits 2024. — but if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025). Health fsa contribution limits 2024 over 55.

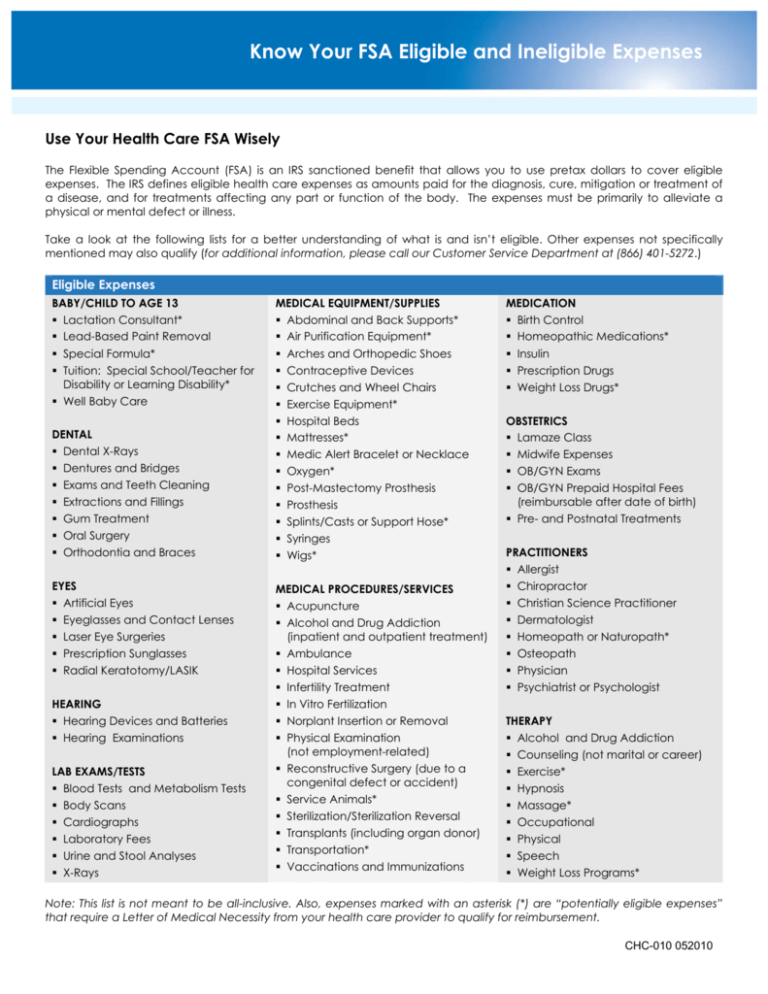

See our list of lpfsa eligible expenses. 5 to learn about the specific eligibility.

Limited Purpose Fsa Limits 2024 Images References :

Source: kateeynadeen.pages.dev

Source: kateeynadeen.pages.dev

Dependent Care Fsa Limits 2024 Irs Ema Margareta, A dependent care flexible spending account can help you save on caregiving expenses, but not everyone is eligible.

Source: neelyqrebecka.pages.dev

Source: neelyqrebecka.pages.dev

2024 Fsa Plan Limits Over 50 Dulcia Margaret, — for 2024, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

.png) Source: coraygiustina.pages.dev

Source: coraygiustina.pages.dev

Limited Purpose Fsa Rollover 2024 Athene Veronika, Health fsa contribution limits 2024 over 55.

Source: agnagenevra.pages.dev

Source: agnagenevra.pages.dev

New Fsa 2024 Limits Fayina Michaela, The new contribution limit will also apply to the limited purpose fsa which reimburses eligible dental and vision expenses.

Source: coraygiustina.pages.dev

Source: coraygiustina.pages.dev

Limited Purpose Fsa Rollover 2024 Athene Veronika, As the name implies, the limited purpose fsa is more restricted in its scope:

Source: coraygiustina.pages.dev

Source: coraygiustina.pages.dev

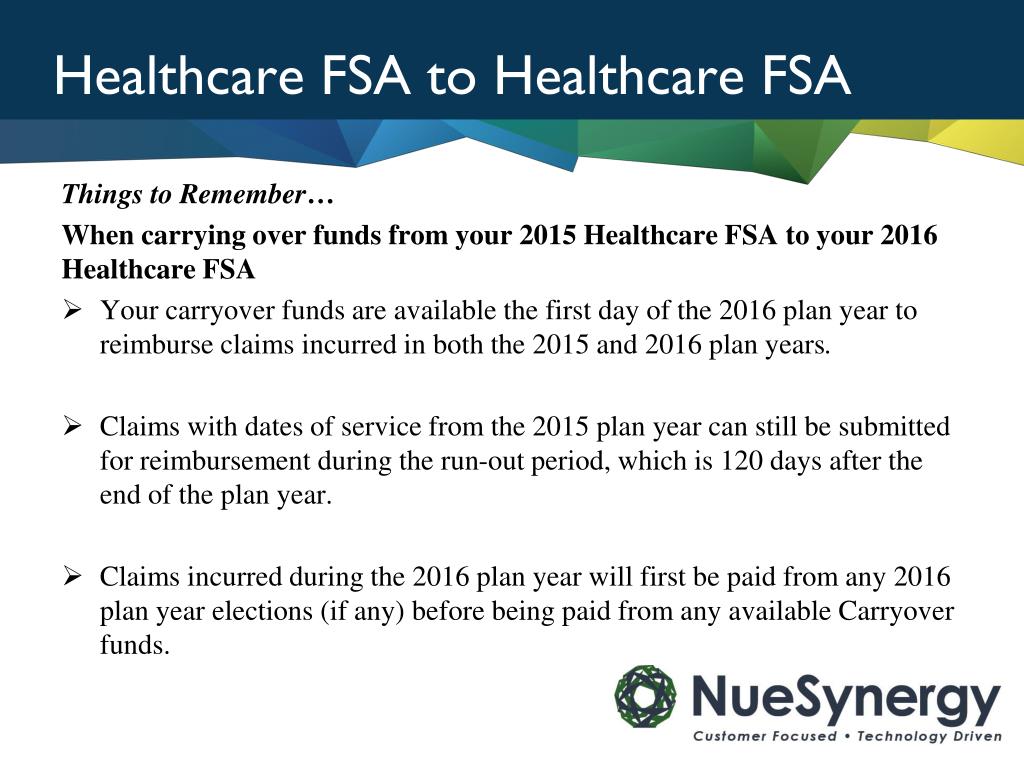

Limited Purpose Fsa Rollover 2024 Athene Veronika, The limited purpose fsa limit for 2024 is $3,200 with a carryover limit of $640.

Source: cassandrywjazmin.pages.dev

Source: cassandrywjazmin.pages.dev

2024 Fsa Limits Daycare Expenses Lucie Stepha, You can contribute a minimum annual amount of $120, up to a maximum annual amount of $3,050 in 2024.

Source: leodorawallie.pages.dev

Source: leodorawallie.pages.dev

2024 Fsa And Hsa Lim … Romy Vivyan, Health fsa contribution limits 2024 over 55.

Source: sueqsarena.pages.dev

Source: sueqsarena.pages.dev

Irs Dependent Care Fsa Limits 2024 Ollie Atalanta, Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health reimbursement arrangements (hra), and.

Source: cecilqjessamine.pages.dev

Source: cecilqjessamine.pages.dev

What Is The Fsa Limit For 2024 Family Karen Marlane, You can contribute a minimum annual amount of $120, up to a maximum annual amount of $3,050 in 2024.

Posted in 2024